Saving money on your bills: tips and tricks

Setting money aside is very important, because you never know when you can have an emergency. So it’s important to learn how to save money on your bills and what methods you can use to start saving today. Which is why we created a list with some of the best money-saving solutions, and here you have some of the best.

Start using the 50/30/20 method

This method means you need to use 50% of your pay on your needs, 30% towards fun and you save 20% for any future needs. It’s a simple approach and the great thing is that once you set it all up, it will work better than you imagine. That’s why it’s well worth giving it a try for yourself.

Use incognito browsers

A great idea here is to ensure that you don’t allow sites to see your browsing history, as some might inflate prices if they see you are interested in a certain product. That’s why you want to delete your history or use incognito mode in browsers to see the real deal.

See if there are workplace benefits

Most workplaces offer benefits like childcare support, healthcare plans and even some local discounts. It’s a good idea to always take advantage of these benefits, because you never really know how much you can actively save.

Use resale platforms

It’s possible to buy and re-sell stuff for a profit. A lot of people do it and it’s a great source of extra income. You just have to take that into consideration and start doing it. Yes, it will take a bit to get started, but in the end it can be well worth the effort.

Ask for price matches

Many times, retailers will price match other offers with the idea that you buy from them. It might not seem like a whole lot, but it works and the best part is that matching various prices can be totally worth it. With that in mind, there are also deal finding plugins for browsers where you can find better deals or even discount codes for anything you buy, Honey being a prime example.

Avoid checking out right away

The reason you want to do that is because most of the time retailers will contact you via email to offer a better deal. It won’t happen every time, but it never hurts to wait. Combine that with the price matches and discount tools you can use, and it’s easy to see you can save money on most if not all your purchases.

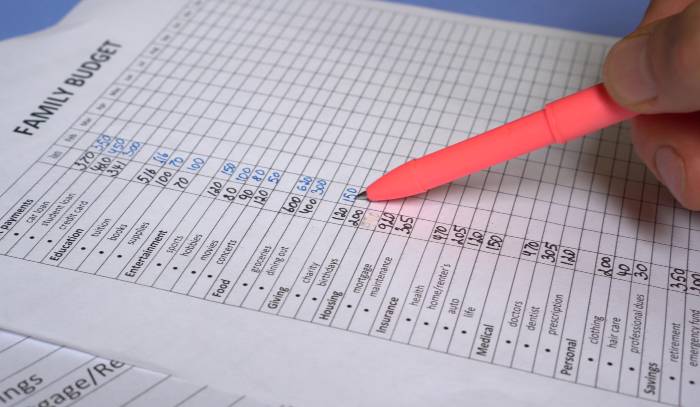

Always track your expenses

Yes, tracking expenses is important and it will make a difference. You always want to focus on using expense trackers and finance tools. These will help you become more financially savvy and that on its own can truly make a huge difference. Just try to take it into consideration and you will be amazed with the quality and results.

Monitor accounts online

You can switch from paper bills to online accounts. This will also help you ensure you pay everything at the right time. It really is worth your time and the quality of this experience is second to none. You can easily monitor as well as manage your account via your phone, which is always great.

Try to establish a no spend day

The reality is that we always spend even a tiny bit of money every day. Which is why having a day when you don’t spend any money is a clever idea. It will allow you to focus more on avoiding any unwanted expenses, plus maybe this is the right time to start saving as a whole. It never hurts to check out this approach and the potential that it brings to the table is very interesting.

Optimize the grocery bills

A good way to save money is via optimizing how much time you spend on groceries. And yes, believe it or not, it always comes down to planning. Making sure that you create a list will usually help save a significant amount of money, and it does bring in amazing potential. There are some challenges that can arise, but for the most part you will be quite impressed with the benefits and style. It does take a bit of a trial and error at first, but you can get the hang of it.

Claim back money

There are situations when you might end up able to claim tax rebates, forgotten bank accounts and so on. If there are any money in your name that you did not claim, then services like My Lost Account might actually be able to help you. Yes, it will be a bit of a challenge at first, and in the end that’s what makes it such a great option all the time.

Avoid throwing away food

Yes, you want to ensure that you stop throwing away any kind of food. Instead, you want to plan your meals accordingly and make smaller portions if needed. That might seem tricky at first, but it works great and it will convey the value and benefits you want.

Don’t shop just brand products

Some brands don’t have the same name recognition as Apple for example, but they still offer you an extremely impressive value for money. That’s why it can be a very good idea to shop for brands that aren’t as popular. You can get a very good product without spending the extra money.

Conclusion

These tips and tricks are great if you want to save money to set aside. You never really know when and how you can start saving, so these tips and ideas can be very handy. The truth is that there’s potential to save anywhere, you just have to get the hang of it. And as soon as you do that, you will be amazed with the benefits and potential. Start implementing these tips and ideas today, and you will have no problem saving money, plus you can always optimize your income and spending too!

Home and Gardening Ideas At home and Gardening ideas we believe inspiring readers about homesteading, self sufficiency

Home and Gardening Ideas At home and Gardening ideas we believe inspiring readers about homesteading, self sufficiency